by Konstantin Golub

Russia is one of the leaders in the world energy trade and exports almost half of the primary energy produced. Natural gas plays significant role in those exports. Russia is encountering new challenges in the European gas market, which is the central in Russia’s natural gas exports. The challenges can broadly be characterised as narrowing niche for natural gas as a result of energy efficiency and CO2 emissions reduction policies as well as inter-fuel competition. Moreover, there is overall target of decreased dependence on Russian supplies in line with the logic of geographical diversification. Obviously, these issues lead to more difficulties in Russia’s search for business strategies in the European market.

In this article, we would like to analyse current situation and possible changes along the supply chain from South Caucasus toward South Eastern Europe. This area is interesting because of its role in transit avoidance within Russian gas export strategy. The second reason to pay closer attention to this region is the potential of formation of a gas-trading hub and implications for Russia’s export strategy. Finally, the role of South Caucasus supply and Turkey transit in Europe’s attempts to diversify its supply sources are also closely connected to the developments in SEE sub-regional gas market.

The future of Russian supply to Turkish natural gas market is unpredictable now, since the unprecedented deterioration of bilateral relations because of Russian military aircraft downed by Turkish fighter on Turkish-Syrian border on November 24, 2015. Russian market power on the Turkish natural gas market is in bifurcation point now. An available market niche for Caspian gas supply in Greece, the Balkans, Central Europe and Turkey exists mostly due to the current market trends and political imperative of reducing dependency on Russia than to economic incentives. Azerbaijani gas will inevitably substitute some of these volumes but not in dramatic proportions.

The main purpose of this article is to assess the potential of development of gas market in SEE and answer the question whether Armenia, Azerbaijan and Georgia pose a significant risk to Russia’s security of demand. Moreover, the article seeks to evaluate the impact of geopolitical developments on the regional gas trade.

The article is based on research conducted under the CASCADE project “Energy Security in the South Caucasus: the View from the Region” (http://www.cascade-caucasus.eu/841).

RUSSIA’S GAS EXPORTS: DIFFICULTIES AND CHALLENGES

Russia is one of the leaders of the world energy trade and exports almost half of the primary energy produced.[1] The Russian trade balance is highly dependent on Urals oil prices, and hydrocarbon exports still dominate in Russian total exports.[2] In the past few years, contributions of the energy sector to the federal budget revenues increased to 52%[3]. The significance of natural gas in this context is not only of budget revenues importance, but also of political significance.[4]

Concerning Russia’s natural gas exports, most gas exports have been directed toward Europe, where Russia provides for 30% of the market volume. A key trend over the past five years is a decrease of Gazprom’s exports to the the Former Soviet Union, while at the same time Russia has expanded its exports of LNG (7% of overall exports, targeted at the Asia-Pacific region).

Natural gas exports are one of the major tools of Russia’s integration into global trade and play a significant role in Russia’s economic and political relationship with the EU and Western CIS countries such as Belarus, Moldova and Ukraine.

The Russia-EU energy interdependence can be characterized as asymmetrical, because Russia is more dependent on the EU energy market than the EU is of Russian energy supplies. Moreover, Russia’s existing western gas transport infrastructure binds Russia to European markets. The Russian Federation is quite vulnerable to EU energy policy both in terms of geography (no diversification alternatives in the medium term) and finances (because of the high budgetary dependence on the financial resources from the EU). The situation is complicated by the influence of transit states, especially the often-hostile policies of the Ukrainian government.

Due to falling of the domestic production, European countries will inevitably increase the imports of fossil fuels, but will apply every effort to diversify away from Russian hydrocarbons. North America could become a net exporter of LNG in the medium term. The emergence of new energy producers and the development of hydrocarbon fields in the Persian Gulf, Brazil, Australia, Central Asia and Caspian region, as well as a significant increase in production of unconventional hydrocarbons will lead to increased competition in all of the key Russian export markets and unfavourable for Russian transformations of pricing mechanisms.

A series of energy crises in the relations between the EU, Russia and the transit countries in 2006, 2007, 2009 and 2014 have significantly contributed to the politicization and, indeed, the securitization of energy deliveries. Although Russia might have been perceived as a relatively stable supplier of energy resources to the EU at the turn of the century, today, in some EU quarters, the discussions about the need of diversification are centered on the allegedly strong dependence of the EU on Russia.[5] The Crimean crisis of March 2014 accelerated a mutual avoidance between Russia and Europe in their energy interdependence. In particular, European states declared their wish to decrease Russia’s share of natural gas imports. At the same time, a number of voices emerged in Russia itself about a necessary diversification to Asia. This trend of mutual avoidance means a culmination of mutual political distrust, which certainly has a long-term effect on the markets.[6]

Russian shares in the gas market in Europe and the CIS will be strictly limited by the demand and measures of consumer countries to reduce dependence on Russian gas.[7]. This forecast actually has a high risk of downward revision due to geopolitical threats and other factors. In this context, the primary current goal of Russian actors is to support the federal budget and energy sector investments through export revenues. This requires maintaining the Russian position in the European energy market. The Asia-Pacific countries will remain a growing market for oil and natural gas, opening up new possibilities for the Russian energy sector, but Asian export vector requires large investments in the development of appropriate energy transport infrastructure.

The status and prospects of economic development of Russia and the situation in the global energy markets shows that the energy sector faces a complex set of internal problems and extraordinary external challenges. They include the following:

- Economic stagnation. Russia’s economy overall has entered the phase of stagnation; the implications of an economic downturn are always in (a) energy demand and (b) investment activity. Moreover, oil and gas exports are insufficient to insure sustainable growth.

- Export revenue expectations are declining. This is due to stagnant gas demand and increasing tensions in the European market.; limited prospects for presence in the Asian gas market are also limited in the next 5-7 years; increasing competition from the new gas suppliers (US, Iran, Australia, East Africa, etc.); and a declining trend in oil and gas prices within the period until 2022-25.

- Russia’s oil and gas resource base deteriorates. In order to maintain oil production and export volumes at the current historically high levels, Russia will need to develop new resources, maximize the remaining potential at existing brownfields, and improve energy efficiency. This will increase the cost of Russian gas supplies both domestically and for external markets, as there is reduction in the development of highly productive and shallow reserves, the climate conditions and challenging, and the new areas of gas production are remote from the centres of consumption.

- Additional challenges introduced by the sanctions regime. Sanctions threaten to postpone several major projects in the energy sector, as well as to defer updating its infrastructure, production assets and technologies.

- High stress on the environment. This is due to the low usage of renewable energy and green technologies prevails.

SOUTH CAUCASUS: CURRENT WEIGHT IN RUSSIA’S ENERGY SECURITY

The energy sectors of the CIS countries suffered the most amongst other key segments of the economy in all the newly independent states after 1991. The energy markets that were originally set up to suit the overall Soviet planning were no longer effective. This was particularly evident for fixed energy infrastructure designed to serve regional energy markets in the most rational way, and in some cases, this meant that countries had to cross the boundaries of their neighbours in order to supply remote parts of their own territories[8]. This issue is also at the core of transit issues that have formed in Russia-EU gas trade: after 1991, a number of independent states have appeared along the supply chain.

In this regard, transit risks are some of the central issues discussed, e.g., in the Russia’s Energy strategy until 2030[9] (RES-2030). The document states that energy markets in Europe and the CIS countries will remain major markets for Russian energy export until 2030, and suggests measures to reduce transit risks, including further development and improvement of a full-fledged export infrastructure. The share of the European market in total Russian energy supplies will steadily decline as a result of diversifying the export in the Eastern direction. However, this key provision is retained in the relevant draft of the new RES-2035, which was being developed throughout 2015 in response to changed economic and geopolitical reality resulting in different outlook for the energy sector.[10]

One of the mechanisms of energy policy is the development of energy cooperation with the countries of the EU, the CIS, and the Eurasian Economic Union (EAEU) as well as the need of rational development of energy transit through the Russian territory. Interestingly, there is almost complete absence of specific South Caucasus’ issues in the RES-2030 and RES-2035. This confirms the suggestion that Russian actors do not expect considerable risks or unique opportunities for energy security and cooperation with Armenia, Azerbaijan or Georgia.

There are several reasons for this situation.

First, the difference in volumes of production, consumption and international trade of energy resources between Russia and the South Caucasus’ countries is very significant. Therefore, it is hard to speak of competition at current stage. Natural gas production in Russia in 2014 was more than 30 times larger than all the South Caucasus. (Tables 1 and 2). Natural gas exports of the only gas production country of South Caucasus, Azerbaijan, was less the Russia’s one by the factor of 20. Russian crude oil production is more than 12 times larger than Azerbaijan; the different in exports of the two countries is 9 times.

Therefore, the South Caucasus’ potential maximum share (in case of hypothetical Russian supplies to Georgia, and no Azeri exports) is only 2.3 % of total current Russian export. In other words, we can conclude, that South Caucasus natural gas market is of very limited interest for Russian energy security as a potential market simply due to its size. There is some potential in cooperation for gas transit, however: 200 mcm of Azeri natural gas were transported via the Russian gas transport system in 2014.[11]

Secondly, most of Azeri energy exports in 2014 was directed to the European OECD countries including Turkey, and constituted 6,068 mcm versus 141,467 mcm of similar Russian supplies (4.2%). Thus, there is no serious competition so far between Russian and Azeri supplies to Europe at the current market situation, and no adequate vulnerability to Russian energy supply.

Thirdly, the geopolitical tensions in South Caucasus distort pure economical motives.

Armenian isolation dictates political reasons of Armenian-EAEU integration and implementation of EAEU energy regulation. At the time of integration of Armenia to the EAEU in the beginning of 2015, the level of Russian influence in the energy sector was incredibly high. Gazprom handled imports and distribution of natural gas. Russian companies have gained the control of power generation, including the hydropower plants cascade, which had been passed to Russians as a repayment of debt for delivered nuclear fuel. Moreover, the future of Russian investment in Armenia is directly linked to the issue of building a new unit of the Armenian nuclear plant. The long-term presence of Russian energy companies in Armenia significantly changed the latter’s energy system to fit the Russian standards, which are the basis the “common energy space” of the EAEU. Thus, Russia through development of this set of bilateral links strengthens the status of key energy player in the region. Armenia, in turn, sees Russia as a guarantor of its security and demonstrates openness to Russian investment in any sector of the economy. That means that the Armenian energy market (including electricity sector) can be considered by Russian actors as a domestic energy market, where social and political stability issues are dominant and form the economic context.

Post-war Russian-Georgian relations warn both sides of direct energy cooperation. Taking into account small market niches, there is no direct influence to Russia’s energy security.

As noted earlier, the most reasonable issue of South Caucasus influence on Russia’s energy policy is current and potential competition from Azeri natural gas supplies to the European market. Presently, it constitutes a negligible 6 bcm/a in comparison with Russia’s 141 bcm/a.[12] However, the market situation will change – but the changes will be discussed in the next part of the article.

What is important, this direction of supplies is not without a transit state. The transit (as well as significant share of demand) is represented by Turkey. Turkish natural gas consumption was 48 bcm in 2014[13]. More than half of that (25 bcm) came from Russia, and Azerbaijan was responsible for delivering 6 bcm (12.5 %). There was no crude oil supplies to Turkey from Azerbaijan in 2014[14], and only 608 thousand tons came from Russia (3.5 % of total crude oil imports).

Turkey also exerts appreciable influence in the South Caucasus–Russian energy security relations, since it has historically been deeply involved in the situation in the Caucasus, and has a special relationship with Azerbaijan («two states – one nation»).[15] The issue of the Armenian Genocide, as well as the problem of Nagorno-Karabakh preclude the normalization of Turkish-Armenian relations. Turkey has close ties with Georgia in the framework of infrastructure projects such as the Baku–Tbilisi–Ceyhan gas pipeline (2006), Baku–Tbilisi–Erzurum pipeline (2007), and railway construction from Baku–Tbilisi–Kars.

WHAT ARE POSSIBLE CHANGES?

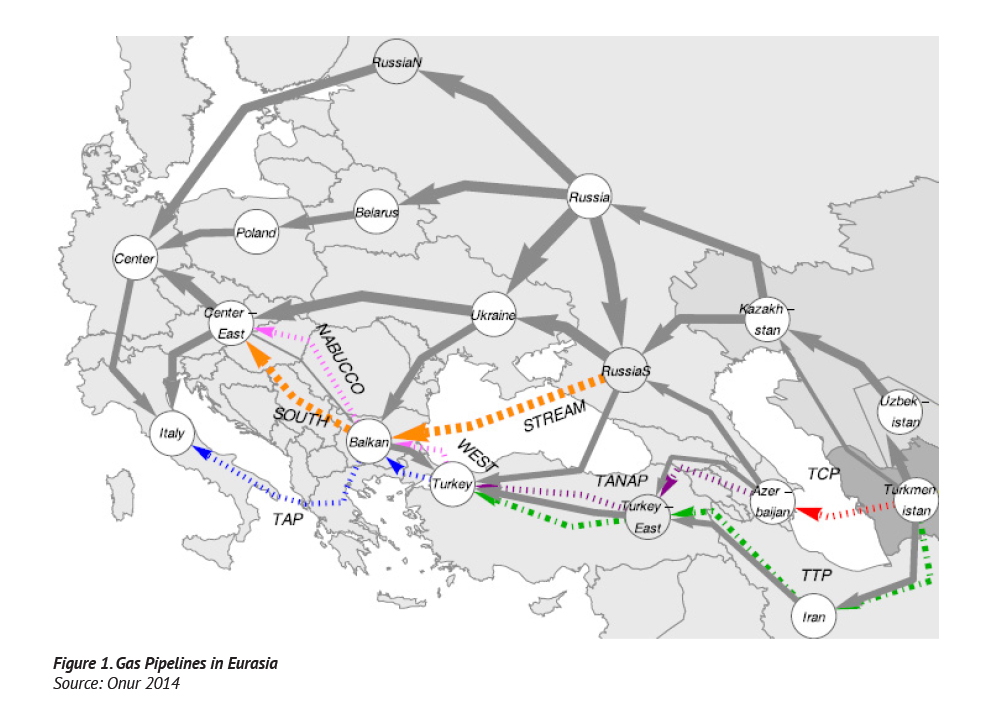

The EU is still interested in new natural gas import facilities all over the continent including LNG terminals and additional pipelines and energy routes, such as the Trans-Adriatic pipeline (TAP), the Trans-Anatolian gas pipeline (TANAP), Nabucco, to some extent Turkish (previously South) Stream (Figure 1) and Nord Stream 2. The Baku–Tbilisi–Ceyhan Oil Pipeline and the Baku–Tbilisi–Erzurum Gas Pipeline (South Caucasus Pipeline), built after the dissolution of the Soviet Union, are important examples of pipelines creating an alternative to the Russian-controlled export routes.[16]

South East European countries will likely dilute their dominant reliance on Russian natural gas supplies as the long-term contracts with Gazprom will begin to expire in the 2020s (contract to Slovenia expires in 2017, to Serbia in 2021, to Bulgaria in 2022, to Slovakia in 2028).

The changes can generally be split into three segments: supply options with the focus on the role of Azerbaijan as the main competitive supplier; the role of Turkey as destination market as well as transit state; the situation in SEE sub-regional market. Below we are looking at each of the sections in more detail.

Turkmenistan and Trans-Caspian

The Trans-Caspian gas pipeline construction is supposed to carry gas from Turkmenistan, Kazakhstan and maybe Uzbekistan through the Caspian Sea to Turkey and Europe via the expanded SGC. As the Caspian legal status is still not settled, this construction is questionable, but there are many efforts from the European side to promote this idea. The potential arrival of these larger gas volumes from Central Asia is a challenge for the Russian competitive position in the European gas market and therefore this project is regarded by Russia as highly undesirable and a serious threat to its national energy security.

The role of Azerbaijan

Azerbaijan occupies a central place in the logistic map of the Greater Middle East and its transport corridors pass almost the entire distance from Iran to the north. Overall, Azerbaijan has been able to position itself as an important actor in the EU’s Southern Corridor initiative.[17]

According to the Outlook for Azeri gas supplies to Europe 2015, natural gas production in Azerbaijan is provided by the giant field Shah Deniz (SD), which output at current Phase 1 is 9 bcm per year is at its plateau level. The next phase of development of the field will increase the plateau by some 17 bcm, to a total of more than 26 bcm from both phases starting from late 2018. The overall annual gas volume of SD2 contracted at the Georgia-Turkey border will be above 16 bcm, of which about 10 bcm are contracted to the European buyers and 6 bcm to Turkish Botas; 1 bcm will be supplied to Georgia as a transit fee.

Azeri SD2 contracts with the European buyers have been signed for 25 years with deliveries starting in 2020. The tail-off period of SD2 starts in the mid 2030s. The contracts with the EU buyers expire in 2045. So, the SD partners have the incentive to explore, develop and produce gas from the SD Phase 3 to maintain the gas deliveries to the customers.

The infrastructure to be built and expanded for those volumes seems to be sufficient to transport some additional 15 bcm annually in the 2020s and 20 bcm annually in the 2030s. This could be achieved via further expansion of SCP. TANAP stage-by-stage expansion will be capable of accommodating the aforementioned volumes, with possible expansion of up to 60 bcm if needed.

Subsequently, there are two markets for rising Azeri natural gas supplies: Turkey and Europe – the same markets where Gazprom operates. The Turkish market seems to be the most commercially profitable for Azerbaijan, because of the short distance and reasonable price. However, a direct Russian-Azeri competitive clash on the Turkish market is avoided by rapidly growing demand for gas in Turkey and its goal of import diversification. Azerbaijan also seeks to diversify demand risk – to the European market.

The role of Turkey

The future of Russian supply to the Turkish natural gas market is unpredictable now since the unprecedented deterioration of bilateral relations because of Russian military aircraft downed by Turkish fighter on Turkish-Syrian border on November 24, 2015. The trade relations between the countries suffer considerable loss due to economic sanctions and actually embargo imposed by Russian government on Turkish business. Since the natural gas supply to Turkey is not an object of these sanctions, the perspective on the Turkish natural gas market is in bifurcation point now.

Turkey has intended (before Russian-Turkish clash on Syrian problem) to import an additional 3 bcm of Russian gas from 2016 at a 6% discounted price to cover the possible supply gap[18]. Moreover, the two countries also have agreed to import 14 bcm to Turkey by an alternative route, the Turkish Stream, as well as 50 bcm of gas, that were already contracted by EU buyers, to the Turkish-Greek border instead of the Ukraine transport system. However, as we can conclude from official Russian rhetoric, natural gas supply by existing routes and even future Turkish Stream (Phase 1) plans will not be revised yet.

The situation in SEE sub-regional market

The key features of the developing Southern gas corridor (SGC) refers to bypassing Russia and exploiting non-Russian Caspian gas reserves.

The Balkans is the only region in Europe, where demand is expected to grow significantly by 2030. The SEE, Central Europe and the Balkans exists as these are keen to diversify away from Gazprom supplies after the expiration of the existing contracts, and this creates a ready market for Azeri gas.[19] Azerbaijan-sourced gas can be transported to these countries via existing or planned interconnectors, which will make the cost of transportation lower and provide supply diversity.

In the most optimistic scenario for Europe with significantly increased LNG imports, additional pipeline gas imports will still be required. Given the likely future, Turkish gas demand growth and its need to import additional volumes of gas, at least half of the 15 bcm of Azerbaijan’s un-contracted “free” gas available in the 2020s can be absorbed by Turkey. The remaining 7+ bcm may be absorbed in Southeast European countries (Bulgaria, Romania, Macedonia, Serbia) and Central European countries (Czech Republic, Slovakia, Poland) and the Balkans.

There is actually an existing market for Caspian gas in Greece, the Balkans and Central Europe mostly due to the current market trends and political imperative of reducing dependency on Russia than to economic incentives. Thus, Azeri gas will inevitably substitute some of these volumes (but not in dramatic proportions, as SD production potential is limited).

RUSSIA’S POSITION AND APPROACHES

Due to a number of political Armenia-Azerbaijan and Russia-Georgia tensions, we can conclude that the common energy market of the South Caucasus could hardly exist. Azerbaijan is self-sufficient in its energy needs and thanks to a variety of international oil companies operating in the country has access to modern drilling technologies. Georgia, due to the continued Armenian-Azeri conflict, enjoys natural gas supplies as a transit fee for SCP. Armenia being blocked by hostile Azerbaijan and Turkey and to some extent pro-NATO Georgia has become a Russian energy satellite.

Georgia is highly dependent on Azerbaijan for its oil and gas provision, although it has no control over the operation of the pipes traversing its territory. The strategic geography allows Georgia to exact better terms from Azerbaijan regarding energy supply, however, it has less weight for fine-tuning it to its political agenda because of its own conflict with Russia. Furthermore, SOCAR has bought and controls most of the distribution companies in Georgia.[20]

The Caspian states, with regard to their energy relations, are no longer pursuing multi-vector approaches. During the past five-to-ten years, the Caspian states have become more concerned about autonomy and gaining control over their energy assets and transportation routes, and maximizing rents than about appeasing and balancing their more powerful neighbors. Currently, political conflicts in the Middle East and Caspian Region have left Azerbaijan’s Shah Deniz field as the only supplier of the Southern Corridor.[21]

Although the European Commission endorses the projects linking the Caspian Region and Central Asia to the European markets, Azerbaijani and Turkmen supplies bring only marginal gains to the European consumers.[22] Transporting gas from the Azeri–Russian border through for example, South Stream appears to be cheaper than using the Ukrainian pipelines.[23]

Despite the enormous costs and difficulties of building such a pipeline, Gazprom repeatedly said it was committed to the project, now changed to Turkish Stream. In the absence of other valid economic reasons for the company, its main purpose appears to be to undermine European ambitions of reducing dependence on Russia’s gas supply by means of the construction of SGC.

TANAP’s uniqueness comes from its promotion of competition both in economic and political terms. TANAP increases the amount of supply, brings an additional supplier through an alternative route, which is controlled not by one nation or state, but by several nation-states.[24] Still, both suppliers, Russia and Azerbaijan enter into tough competition with LNG imports, where a competition for supplies leads to a loss of control over pricing. A new market paradigm affects the future LNG export plans and already demonstrates that Russia is changing its market practices compared to the ones previously existing in exports to Europe. Implications for Europe are also significant as European consumers enter into a tougher competition with Asia for LNG supplies. Hence, their attempts to import non-Russian gas will be somehow challenged by the price dynamics in Asia. This actually means that the security of supply for the Europeans is increasingly located in the development of the Asian markets rather than in their relations with Russia.[25]

Actually, Russian actors perceive their role in energy security of the South Caucasus in the following dimensions. Firstly, energy support of Russian citizens and Russian allies is essential. It concerns both Armenian energy supply and management, and ensuring energy stability in Abkhazia and South Ossetia. Secondly, the construction of TANAP and TAP does not constitute a serious menace for Gazprom market positions in Europe due to (a) political motives of European energy policy, (b) rising demand in Turkey and in the Balkans countries, (c) limited possibilities of Azeri supply building-up. Thirdly, forming a gas hub (as a physical intersection of pipelines) on the Greek-Turkish border at the end of TANAP may facilitate Gazprom’s efforts in negotiating the rerouting of gas supplies from Ukrainian transit to Turkish Stream.

Pragmatic relations with Azerbaijan should be maintained in order (a) to secure Russian business share in Shaz Deniz consortium (Lukoil), (b) to provide the potential growth in Russian transit of Azeri gas, (c) to escape being into a ruinous pipeline building race.

A Trans-Caspian pipeline contradicts Russian national interests on the European gas market and should be set aside while Turkmen gas should be transited either via Russia or to China or India.

CONCLUSIONS

Russia’s position in the dynamic and highly competitive global energy markets differs greatly from the previous years. The main long-term external threat is a drop in revenues from energy exports due to the stagnation in demand and changes in the regulation and pricing on major Russian export energy markets. The centre of the demand growth has moved to emerging markets mainly in Asia where the Russian presence is limited. The competitive advantages of Russian energy companies, arising from the Russian ruble devaluation in 2015, will disappear in a few years due to the increased cost of investment resources and limited access to foreign technology. Consequently, a radical increase in the flexibility of export policies, product and geographical diversification of supply, and a significant reduction of Russian companies’ costs are required.

Russia is experiencing notable problems in the European gas market – the main destination to its natural gas exports. South Caucasus may just be part of that story for Russia. Firstly, South Caucasus natural gas market is of limited interest for Russian energy security in terms of market diversification or enhanced gas export volumes. Secondly, the region is home to two potential strong players who may affest Russia;s energy policy and energy security. These two players are Azerbaijan and Turkey.

Most of Azeri energy exports in 2014 was directed to the European OECD countries, including Turkey, and mounted to only 4.2% of Russian supplies to these countries. Thus, up till now there has not been any serious competition between Russian and Azeri supplies to Europe, and no adequate vulnerability to energy security. However, potentially, competition from the Azeri gas competes to replace part of Russia’s share in the European market. There is actually an existing market for Caspian gas in Greece, the Balkans, Central Europe and Turkey mostly due to the current market trends and political imperative of reducing dependency on Russia than to economic incentives. Azeri gas will inevitably substitute some of these volumes.

The future of Russian supply to the Turkish natural gas market is unpredictable now since the unprecedented deterioration of bilateral relations because of Russian military aircraft downed by Turkish fighter on Turkish-Syrian border on November 24, 2015. The trade relations between the countries suffer considerable loss due to economic sanctions and actually embargo imposed by Russian government on Turkish business. Since the natural gas supply to Turkey is not an object of these sanctions, the perspective on the Turkish natural gas market is in bifurcation point.

Konstantin Golub graduated from Saratov State Socio-Economic University (Faculty of World ecomony, 2009) and Saratov State Academy of Law (Institute of Jurisprudence). In 2009-2011 he pursued MA degree at the National Reseach University – Higher School of Economics, Faculty of World Economy and World Politics. Konstantin defended PhD dissertation on theory of law in 2012. During 2011-2013 K. Golub worked for the Department of budget policy in the spheres of innovation, civil industry, energy, telecommunications, and public-private partnership of the Ministry of Finance of the Russian Federation. Currently K. Golub is a project manager at MegaFon Headquarters.

Address for correspondence: kgoloub@gmail.com

Notes:

[1] For statistics on Russia’s natural gas reserves, see BP Statistical Review of World Energy. BP: London, 2015.

[2] Fuel exports provide more than 70% of export earnings and 18-19% of GDP. In the past few years, contributions of the energy sector to the federal budget revenues increased to 52%. The share of energy sector investments in the Russian economy has continued to grow and reached 38.9% in 2013. The data of the Federal State Statistics Service. Available at: http://www.gks.ru/bgd/regl/b13_58/IssWWW.exe/Stg/06-09.doc

http://www.gks.ru/free_doc/new_site/vnesh-t/exp_2012-2013.xls

http://www.gks.ru/free_doc/new_site/vvp/tab10a.xls

http://www.gks.ru/free_doc/new_site/business/invest/Inv-OKVED.xls [Accessed: November 10, 2015]

[3] The data of the Ministry of Finance of the Russian Federation. Available at: http://budget.gov.ru/static-report/mdxexpert/index.html?reportId=36b384d0-0f87-4aaf-b121-e8471b4e6f41# [Accessed: November 10, 2015]

[4] For info on significance of natural gas for Russia’s economy, see Mitrova T. The Political and Economic Importance of Gas in Russia. In: J. Henderson, S. Pirani (eds.). The Russian Gas Matrix: How Markets are Driving Change. Oxford: Oxford Institute for Energy Studies, 2014. Pp. 6-38.

[5] Kratochvıl P., Tichy L. (2013), EU and Russian discourse on energy relations. Energy Policy, 56, p. 398.

[6] Belyi A. (2015), Russia’s gas export reorientation from West to East: economic and political considerations. Journal of World Energy Law and Business, 2015, Vol. 8, No. 1.

[7] Even under favourable conditions, the volume of Russian supplies to the European gas market by 2035 will not exceed 150-170 bcm/a, according to the 2015 Draft of the Russian Energy Strategy for the period to 2035. The document further states that Market share in the CIS will not exceed 45 bcm/a with a high probability of decline. A decrease by 2035 of 55-50% of Russian oil exports to Europe is also expected. On the other hand, the high and growing demand for gas in Asia creates good preconditions for increasing deliveries of Russian natural gas. Potential export volumes in this area could be from 100 to 150 bcm/a by 2035. Meanwhile, the prices at the European and Asian gas markets are projected to decrease – from 375 dollars/tcm (which was an average export price for natural gas supplied to CIS countries in 2012) to 315-370 dollars/tcm in 2035, – due to the dynamics of oil prices, and excess supply. Russian Energy Strategy for the period to 2035. Draft 2015.

[8] IEA (2014), Eastern Europe, Caucasus and Central Asia. Highlights. Paris: OECD / IEA. Available at: http://www.iea.org/publications/freepublications/publication/eastern-europe-caucasus-and-central-asia-highlights.html [Accessed: November 10, 2015]

[9] Russian Energy Strategy for the period to 2030

[10] Russian Energy Strategy for the period to 2035. Draft 2015

[11]OJSC Gazprom (2014), Annual Report. Available at: http://www.gazprom.ru/investors/reports/2014/ [Accessed: November 10, 2015]

[12] The statistics of the Central Bank of Russia shows even more – 174,3 bcm of Russian natural gas export in 2014. For methodologically appropriate comparison we use the IEA Natural Gas Information 2015. IEA (2015), Natural Gas Information. Paris: OECD/IEA.

[13] IEA (2015), Natural Gas Information. Paris: OECD/IEA.

[14] IEA (2015), Oil Information. Paris: OECD/IEA.

[15] Stegniy P., (2015), Together on the “Heartland.” Russia in Global Affairs. Available at: http://www.globalaffairs.ru/number/Vdvoem-na-khartlende-17312 [Accessed: November 10, 2015]

[16] Leal-Arcas R., Rıos J.A., Grasso C., 2015. The European Union and its energy security challenges. Journal of World Energy Law and Business, 2015, pp. 44-58.

[17] Shadrina E., 2014. Russia’s natural gas policy toward Northeast Asia: Rationales, objectives and institutions. Energy Policy, 74 (2014), p. 58.

[18] According to the Memorandum of Understanding signed by Turkey and Russia in December 2014,

[19] The Outlook for Azerbaijani Gas Supplies to Europe: Challenges and Perspectives. The Oxford Institute for Energy Studies, June 2015. Available at: http://www.oxfordenergy.org/wpcms/wp-content/uploads/2015/06/NG-97.pdf [Accessed: November 10, 2015]

[20] Abbasov F.G., 2014. EU’s external energy governance: A multidimension alanalysis of the southern gas corridor. Energy Policy, 65 (2014), p. 29.

[21] Stegen K.S., Palovic M., 2014. Decision-making for supplying energy projects: A four-dimensional model. Energy Conversion and Management, 86 (2014), p. 647.

[22] Cobanli O., 2014. Central Asian gas in Eurasian power game. Energy Policy 68 (2014), p. 353.

[23] Chyong C.K., Hobbs B.F., 2014. Strategic Eurasian natural gas market model for energy security and policy analysis: Formulation and application to South Stream. Energy Economics, 44 (2014), p. 202.

[24] Ozdemir V., Yavuz H.B., Tokgoz E., 2015. The Trans-Anatolian Pipeline (TANAP) as a unique project in the Eurasian gas network: A comparative analysis. Utilities Policy xxx (2015), p. 4.

[25] Belyi A., 2015. Russia’s gas export reorientation from West to East: economic and political considerations. Journal of World Energy Law and Business, 2015, Vol. 8, No. 1.