by Glenda Pavon-Suriel

Abstract

Development of hydrocarbon resources in the Arctic shelf is a topic of increasing interest. This is in light of the effects of climate change in the region and recent findings of enormous resource potential. The combination of the environmental implications of resource extraction in the Arctic with the demand for natural resources for worldwide energy consumption and the economies of energy producers has led to the increasing politicization of hydrocarbon exploitation in the Arctic. Russia, as a worldwide leader in energy production, as well as the largest Arctic state, has a huge stake in exploring and developing Arctic resources. Considering recent Western sanctions against Russia, and the oil and gas industry in the Russian Arctic specifically, this paper examines the question of whether or not the sanctions will prevent Russia from extracting and exporting Arctic hydrocarbons and whether the effect will be long term. Despite the disadvantages of the sanctions regime as well as other disadvantages regarding the export of resources from the Arctic, Russia is already developing and exploring the region. In addition, the time constraints for developing resources with current technology and the lack of access to exports from the Arctic means that other Arctic energy producing countries will delay Arctic resource development. This delay will give Russia time to develop further technologies and seek funding from non-American and non-EU countries. In this paper I conclude that in the long run the sanctions will not prevent Russia from developing and exporting hydrocarbons from the Arctic.

- Introduction

The Arctic is a massive area that spans about 1.5 times the size of Russia.[1] It is unique in terms of its ecosystem and climate, but also when it comes to geopolitics. Due in part to climate change, the area is drawing international attention and becoming increasingly politicized. In 2008, the US Geological Survey (USGS) published a report estimating huge potential amounts of undiscovered oil and gas reserves in the Arctic. This discovery, combined with the melting polar ice caps and thus easier access to the potential resources, has led to significant attention focused on the region. The Russian Federation has the largest land mass claims in the Arctic, which is one of the main reasons it has the greatest interests in the region. As a country that relies heavily on its oil and gas industry, Russia needs new fields to offset lower production from its aging fields.[2] Oil and gas activity and production in the Arctic is therefore particularly relevant to Russia. The sanctions regime, however, may limit Russia’s ability to develop resources in the Arctic because it eliminates Western investments into the energy sector.[3] Nonetheless, Russia currently does maintain a presence in the Arctic and continues developing oil and gas resources when Western companies have withdrawn from high price Arctic projects facing increasing political pressure from climate change activists.

Considering the disadvantages of high costs, climate change and geopolitical concerns, what are the incentives for Russia to develop natural resource extraction in the Arctic? If the sanctions are aimed at limiting Western investment into high cost Arctic projects then will the Western sanctions prevent Russia from drilling in the Arctic? If the sanctions will prevent Russia from exploiting Arctic natural resources will the effect be long term?

The structure of this paper is as follows: in the first section I will describe the sanctions against Russia and how they are relevant to Russia’s activity in the Arctic. I will then list and describe the economic as well as geopolitical disincentives and incentives for Russia to develop hydrocarbons in the Arctic region. I will then describe current activity in the Arctic. Finally, I will explain why there are several reasons Russia will develop Arctic hydrocarbons despite the disadvantages associated with this. Using qualitative methods, I will speculate as to what Russia is likely to do in the medium term. I will then conclude with long-term expectations.

- Sanctions overview and Russian interests in Arctic hydrocarbons

2.1 Western Sanctions

The US sanctions focus in large part on the Russian energy industry. The sanctions not only target the financial systems by eliminating financing and investment funds, but they also target the development of technologies that would support the energy industry, particularly the oil and gas industry. According to the US Department of State, under Executive Order 13685 ‘the provision, exportation, or re-exportation of goods, services (not including financial services), or technology in support of exploration or production for deepwater, Arctic offshore, or shale projects that have the potential to produce oil in the Russian Federation’ are prohibited. [4]

The sanctions are aimed at ‘severely restricting Russia’s freedom of maneuver in the Arctic’.[5] Further, the sanctions prohibit the supply of goods and services for the exploration of oil and gas in Russia and its maritime area, whilst also specifically stating the restriction of provision of items that aid offshore Arctic oil or gas exploration.[6] This paper examines the effectiveness of the sanctions on Arctic hydrocarbon development and production through qualitative data. What are Russia’s plans in the Arctic? What are current projects in the Arctic for hydrocarbon production? Can Russia gain investments from countries that are not subject to the United States or European Union sanctions?

2.2 Russian interests in Arctic hydrocarbons

The largest country in the Arctic, Russia has major development plans to transform the Arctic into a spring of resources.[7] Global warming and the subsequent melting of the ice caps in the region is facilitating access to the region’s vast resources, particularly hydrocarbons. The Russian Arctic strategy outlines the region’s economic importance to the country as an energy producer, both currently and in the future. As Michael Roi states: “The Russian leadership clearly emphasizes the importance of the Arctic to the country’s wealth and competitiveness on global markets and as a major source of revenue, mainly from the production of energy.[8]” This trend will continue in the future as Russia’s current fields age and production levels diminish. In order to maintain the status as an energy superpower, Russia will need to look to its Arctic resources.[9] Many of these resources will be offshore: according to the USGS, as much as 84 percent of the oil and gas resources in the Arctic are located offshore. This will require investments and technology Russia may not have, and that Western companies will not be able to provide due to sanctions.

- Incentives and Disincentives for Arctic Drilling

- Incentives

Russia’s incentives for exploiting the Arctic’s resources are mainly economic. According to Rotnem, one of the focuses for Russia’s Arctic strategy is to use the area for long-term economic development.[10] Tax revenues from fossil fuel production and oil and natural gas exports account for 40 percent of Russia’s budget and many of the country’s current resources come from aging fields where production is declining.[11] Russia must maintain its current production rates if it wants to keep its energy superpower status. This will require Arctic resources.[12]

Beyond economic interests, ‘Russia has by far the greatest intrinsic interests in the Arctic’.[13] According to the US Geological Survey, 30 percent of the world’s undiscovered natural gas reserves and 13 percent of the globe’s oil reserves are located in the Arctic, with Russia’s offshore shelf region perhaps holding the majority share of these totals.[14] Further, massive amounts of undiscovered oil are thought to lie in the Arctic basin just north of Russia, with a potential for extraction that will exceed Russia’s Arctic onshore oilfields.[15] If long-term projections are considered, it is evident that the Arctic will be a source for future oil and gas supplies. According to Baev and Boersma, unless long-term projections are false, an additional 15 million barrels of oil per day will be needed by around 2035. “The Arctic is still viewed as one of the last frontiers where this precious resource may be found.[16]”

- Disincentives

Despite the incentives for Russia to begin developing hydrocarbons in the Arctic, there are many disincentives that may prevent Russia from doing so in the near future. Firstly, exploring and developing the Arctic for hydrocarbon resources will be extremely costly. According to Statoil, the costs of exploring and developing some Arctic wells could be as much as $500 million, four or five times the cost of deep-water wells not in the Arctic.[17] Current sanctions will prevent Western companies from providing the necessary funding for these projects, which presents tremendous challenges.

In addition to the high cost, drilling operations in the region are not possible year round. Extreme weather conditions and technical difficulties mean that in many parts of the region, drilling can only occur for 106 days each year.[18] Given the fact that exploiting the region’s hydrocarbons will require large investments and the fact that drilling can only take place for half a year implies low relative profitability of Arctic hydrocarbons. As Rotnem states: “With hydrocarbon prices at current levels the vast majority of Arctic production remains unprofitable.[19]”

Further, there is a level of uncertainty regarding the amount of hydrocarbons thought to exist in the Arctic shelf. The USGS report contains only estimates ‘based on geological probabilities and not actual finds’.[20] With no guarantees as to the amount of hydrocarbons that will be extractable, investments are more risky and less appealing. This makes further investment into the area less likely.

There are also major climate concerns for the region. These climate concerns are making the Arctic an increasingly politicized zone because of the risks to the area. The Arctic is particularly susceptible to global warming. Temperatures rise fastest on the earth’s poles. The white snow and ice reflect sunlight, but the water absorbs the heat from the sun, instead. The seas then warm which melts more ice and then causes more heat from the sun to be absorbed. This then causes a snowball effect that amplifies temperatures.[21]

The Arctic is also an area vulnerable in the case of an oil spill. A major spill has never occurred and thus the process of cleanup is unknown. Conventional technology that removes oil from the surface of the water will not be effective amidst broken ice.[22] If oil from a spill were to spread and drift away, it could circle the Arctic for decades because at such low temperatures oil does not evaporate.[23] Burning the oil would perhaps be the most efficient method of removal, but this would lead to black soot covering much of the snow and further exacerbating climate change effects in the region.

- Prospects and current status in the Arctic

4.1 Current hydrocarbon projects

Despite incentives and disadvantages, the fact that Russia has already been extracting hydrocarbon resources in the Arctic must not be overlooked. Although much of the extraction is onshore, ‘Russia has been active in natural gas and oil exploration since at least the 1970’s’.[24] Thus the Arctic is already an important area for Russian natural gas and oil production. The Russian oil producer, Gazprom Neft developed the Prirazlomnoye field on the Arctic shelf located in the Pechora Sea, and began exporting in 2014.[25] Gazprom Neft also began commercial production at Novoportovskoye in 2014, according to their website.[26] These projects demonstrate that the Russian government and Russian companies are committed and able to develop hydrocarbon resources in the Arctic, despite the sanctions.

4.2 Eastern pivot

It is not unlikely that Russia will look outside of European and American companies for investment in the development of the Arctic’s hydrocarbon resources. For example, Russia is already looking to foster relationships with Asian countries, China in particular.[27] Cooperation with China will not only serve Russian interests but Chinese interests as well. Demand for energy is projected to grow in the Asian economies, which will mean Arctic resources are bound to grow in importance.[28] In short, Arctic resources will increase in importance for Russia if it wants to continue its status as a top energy producer, but also for China, that will look to Russia as a supplier for future energy. Considering the global structure of natural gas demand, Asia-pacific and China in particular, will be a key market for Russian natural gas in the long term. [29]

China’s importance in Arctic development is also demonstrated by the fact that other Arctic states have begun fostering a stronger business relationship with China. Other Arctic states, meanwhile, are also not far behind. Iceland has stated that it is interested in developing stronger relations with China on Arctic resources, development, scientific research and other businesses, and China Offshore Oil Corporation (CNOOC) has been granted a license to carry out oil and gas exploration in Iceland’s Dreki region’.[30]

Chinese companies are already investing in various industries in the far Northern regions of Russia. Aside from telecommunications and pharmaceutical company investments, the Chinese company, Huaqing Housing Holding, has invested in the oil refinery sector in Yakutia as recently as 2015. Other Far East Asian companies are also investing in areas of the far North such as Yakutia.[31] In 2016, Japanese Mitsui & Co. Ltd. invested $194 million dollars in the construction of wind farms.[32] This signals that investment from foreign companies, particularly those from Asia are well underway in the Russian Far North energy industry.

4.3 China’s presence in the Arctic council and interests in the Arctic

In addition to closer business ties, China was inducted into the Arctic Council as an observing member. In 2013, the Arctic council, which is made up of the eight Arctic countries (Canada, Denmark (through Greenland), Finland, Iceland, Norway, the Russian Federation, Sweden, and the United States), added six non-Arctic countries including China, Japan, and Singapore as permanent observers with no voting rights.[33] This demonstrates the significance of non-Arctic countries and their role in key aspects of development and business. Indeed, hydrocarbon resource development will be central to development in the region.[34]

China also has its own intrinsic interests in developing closer business ties with Arctic states. As the new observer states, China has been the most eager for an increasing role in the region.[35] China’s interest in the region is due to in large part to trade and natural resources, although the Northern Sea Route is also of interest, because it would cut down on fuel transport costs. This route would cross Russian territorial waters, significantly reducing the travel distance and therefore costs between Rotterdam and Shanghai.[36] Since China is a large energy importer, Russian supplies from the Northern Sea Route are a logical choice to fulfill part of China’s energy needs. Long-term agreements with China National Petroleum Corporation (CNPC) providing oil and gas supplies from Russian offshore fields are already in place.[37]

4.4 The Northern Sea Route

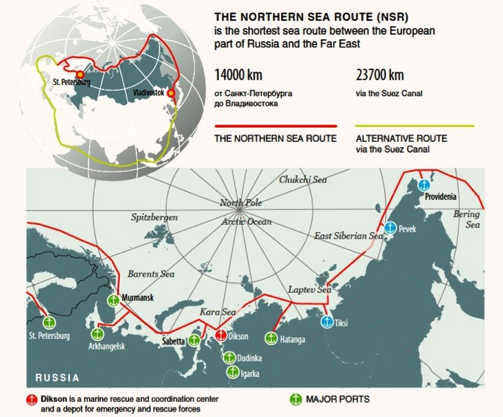

Sea transport is the primary way external exports are supplied from Russia. The Volume of goods going through Russian Sea ports is projected to increase by almost 30 million tons by 2030. [38] Major sea transport through Russian waterways occurs along the Northern Sea Route (NSR). Traffic along the NSR increased by 35% from 2015, according to the NSR administration.[39] Much of this increase can be attributed to the transport of oil and gas. Along the NSR the volume of oil and oil products increased 4 times to 3,473,822 tons. The volume of Liquid Natural gas shipments also increased. Since the Far East, particularly China is a primary market for Russian oil and gas supplies the NSR will be increasingly critical to the export of Russian oil and gas supplies from the Arctic.

The NSR is not only significant for supplies to China but the route would also be important for Japan. For Japan, which is the largest LNG importer in the world, the opening of the region means increased access to supplies from the Arctic, facilitation of transport, and thus diversification of energy supplies. Thus, the Northern Sea Route is significant in terms of transport of Arctic supplies.

Russia has already begun developing the NSR. Leadership in Russia hopes to develop the route for exporting Russia’s hydrocarbons. The Russian government proclaims that the route is forty percent shorter, cheaper, and safer than the pirate infested routes along the Indian Ocean and the Straits of Malacca.[40] Large plans are thus underway for the development of the Northern Sea Route.

The Northern Sea Route is significant because it provides a way to transport oil and natural gas from the Arctic. Easier transport of oil and natural gas from the Arctic, despite the higher costs, makes it more appealing. If Arctic supplies were not only expensive to extract but also difficult for Russia to transport development of the hydrocarbons would not be worth the effort. This is well illustrated by the case of Alaskan offshore supplies from the US. According to Fjærtoft et al. the outer continental shelf of Alaska has declined in production.[41] Most importantly, Fjærtoft et al. stated that no gas has been exported due to a lack of an adequate export route.[42] Similarly, Shell stopped exploration and development in the Chukchi Sea in 2015. A large part of this consideration was likely the fact that ‘transportation of hydrocarbon products from the Chukchi Sea is not straightforward’.[43] Although hydrocarbon exploration and development in the Arctic will come at a high cost, the Northern Sea Route is an incentive to export resources from the Arctic.

Source: Russian Direct Investment Fund, 2013. Available at: <http://investinrussia.com/data/files/sectors/TransportEng.pdf>

4.6 Time constraints of hydrocarbon development

Another important consideration is the time constraints of Arctic hydrocarbon development. According to Dadwal, accessing hydrocarbon resources from the Arctic and bringing them to the market could take twenty years or more.[44] Although this can be considered a drawback to the development of Arctic hydrocarbons, this may not be a drawback in the Russian case. Given the current low cost of petroleum products when combined with a lengthy timeline to develop Arctic hydrocarbons, this will allow Russian development to occur gradually. Gradual development will then take place until Arctic resources are more profitable in relation to other hydrocarbons or when Russian technology can efficiently capitalize on their extraction. In the short to medium term, shares of Arctic hydrocarbons in the world energy mix will not likely increase, whereas in the long term they will increase in importance. Their long term significance in the energy mix will be due not only to improvements in technology or the higher costs of petroleum products, but also because demand will increase, particularly in Asian countries.[45] China, Singapore, and Japan, which were all admitted to the Arctic council as observing members, are generally described as ‘energy hungry’.[46] This appetite for energy and for fossil fuels, combined with the acknowledgement of their influence in the Arctic by the Arctic Council, implies that in the long term, these Asian countries will look to Russia and to Russian Arctic hydrocarbons for their energy demands.

4.7 Sanctions Backlash?

The Western sanctions against Russia may be a disincentive to exploration and hydrocarbons in the Arctic because they limit available technology and financing, but they may also be a provocation for Russia to act more proactively in the Arctic region. Russia is increasingly militarizing the region, and Dadwal stated that tensions between Russia and the West could draw them into conflict.[47] While conflict can mean military aggression it can also mean more resolve to explore and produce fossil fuels on Russian Arctic territory. Russian behavior in the Arctic has been described as frustrated with Western sanctions.[48] However, it is important to note that Rotnem describes many examples of Russian cooperation and diplomacy in the Arctic: “A significant body of evidence exists that demonstrates Russia’s earlier commitment to a collaborative agenda in the Arctic. […] Russia’s initial claims submission to the United Nations Commission […] was evidence that the country was committed to following the established international legal process for settling […] disputes.[49]” Furthermore, despite other geopolitical disputes, the Arctic has been an area characterized by geopolitical stability. Relevant countries have abided by international laws, which has been essential to maintaining stability within the region.[50] The Arctic council, which has 8 permanent members, ‘has a hard track record of establishing and facilitating cooperation between Arctic states’. [51] Since international law holds that all countries have sovereign rights over the natural resources within their territories and Russia will not likely agitate the cooperation that characterizes the Arctic through aggressive military action, then perhaps that frustration will serve as motivation to develop their hydrocarbon resources in the Arctic. While the sanctions against Russia may be characterized as a source of frustration, that frustration may lead Russia to act in a collaborative and law abiding way, not wanting to disrupt the cooperation that characterizes the region. The Russian foreign policy declaration states that the Russian Federation sees the existing international legal framework as sufficient to resolve any regional disputes.[52] Indeed, regional cooperation in the Arctic is crucial for each of the Arctic states to pursue their regional goals and ensure the prosperity of each of their Arctic populations.[53] When recent history demonstrates mutual diplomacy, it may be futile to say that the sanctions against Russia will be a source of conflict in the region. However, it may not be extreme to project that Russia will demonstrate a commitment to develop Arctic resources to which they have sovereign rights.

4.8 Ongoing domestic investment in the Russian Arctic and Far North

The final consideration for Russian oil and gas drilling in the Arctic is whether there is domestic capacity for investments in the region in spite of the sanctions, and if ongoing projects are underway. According to the Ministry of Economic Development of the Russian Federation, currently there are no federally funded projects in the Russian Arctic, but there are Russian companies which are investing heavily in many industries, including in the energy industry.[54] In Murmansk, several Russian companies have invested around $127 trillion Rubles into the development of transportation and communication, such as railways and road infrastructure.[55] Much of these investments target construction of infrastructure for the transport of coal, oil, and petroleum products. There are also ongoing projects for the development and extraction of other natural resources such as palladium, gold, nickel, and platinum in the Murmansk region. Russian companies are investing in key regions of the Russian Far North, and although investments are not only occurring in the energy sector of these regions, the development of transport infrastructure as well as housing, agriculture and forestry, and service industries will help to draw more commerce to the regions. The growth of other industries in the Russian Arctic will help to bolster the energy industry by increasing the attention and investment opportunities available to those target areas.

- Conclusion

Russia is not only the largest Arctic country but it has a long history of development in the region. Although the Western sanctions target the oil and natural gas industry in the Arctic, Russia already has a presence in the region and has expressed its commitment to further explore and develop the region for natural resources. Increasing energy demand worldwide provides a further impetus for Russian natural resource development in the Arctic in light of the fact that many onshore fields are aging. Although the challenges are numerous, the incentives to develop and export hydrocarbons from the Arctic are more compelling. Countries not involved with the Western sanctions also have incentives to develop Arctic hydrocarbons and natural resources. This will allow Russian oil and gas producers to appeal to them for investments and technology necessary to exploit the Arctic’s natural resources. In the long run when newer technologies are developed and the price of petroleum products increases, Russia will already have enough experience in the region. By committing to act in spite of sanctions now, Russia has ensured it will be a leader in the Arctic for many years to come.

Glena Pavon-Suriel is an ENERPO alumnus focused on professionally growing in energy relations and currently living in Saint Petersburg.

[1]Arctic Info Agency, 2016. Arctic history. [online] Available at: < http://www.arctic info.com/encyclopedia/arctic-history/> [Accessed 4 November 2016].

[2] Dadwal, S. R., 2014. Arctic: the next great game in energy geopolitics? Strategic Analysis, [e-journal] 38(6) pp. 812-814. November 2014. Available at: <http://www.tandfonline.com/loi/rsan20> [Accessed 4 November 2016]

[3] Rotnem, T., 2016. Putin’s Arctic strategy. Problems of Post-Communism. [e-journal] 27 October 2016. Available at: <http://www.tandfonline.com/loi/mppc20> [Accessed 4 November 2016].

[4] US Department of State. Ukraine and Russia sanctions, 2017. [online] Available at: <https://www.state.gov/e/eb/tfs/spi/ukrainerussia/> [Accessed 6 February 2017].

[5] Rotnem, T., 2016. Putin’s Arctic strategy.

[6] Reed S., 2014. Overview of the US and EU sanctions on Russia. [online] Available at: <https://www.reedsmith.com/files/Publication/9221cf81-e4f7-4907-ab2c-f7dc249eac58/Presentation/PublicationAttachment/441e0ec9-dbd8-4c3a-b1fa-0bf7ed4d5872/alert_14-255.pdf> [Accessed 6 November 2016].

[7]Morozov, Y., 2012. Arctic 2030: What are the consequences of climate change? The Russian response. Bulletin of the Atomic Scientists, [e-journal] 68(4), pp. 22-27. 2012. Available at: <http://bos.sagepub.com/content/68/4/22> [Accessed 4 November 2016].

[8] Roi, M. L., 2010. Russia: the greatest Arctic power? The journal of Slavic military studies, [e-journal] 23(4) pp. 551- 573. Available at: <http://www.tandfonline.com/loi/fslv20> [Accessed 4 November 2016].

[9] Roi, M. L., 2010. Russia: the greatest Arctic power?

[10] Rotnem, T., 2016.

[11] Idem.

[12] Dadwal, S. R., 2014. Arctic: the next great game in energy geopolitics?

[13] Idem.

[14] Rotnem, T., 2016.

[15] Idem.

[16] Baev, P. K. and Boersma, T., 2016. With Russia overextended elsewhere, Arctic cooperation gets a new chance. Order from Chaos, Brookings Institute. [online] Available at: <https://www.brookings.edu/blog/order-from-chaos/2016/02/18/with-russia-overextended-elsewhere-arctic-cooperation-gets-a-new-chance/> [Accessed 16 May 2017].

[17] Dadwal, S. R., 2014.

[18] Idem.

[19] Rotnem, T., 2016.

[20] Dadwal, S. R., 2014.

[21] Anderson, A., 2009. The great melt: The coming transformation of the Arctic. World Policy Journal, [e-journal] 26(4) pp. 53-64. Available at: <http://wpj.sagepub.com/content/26/4/53.citation> [Accessed 4 November 2016].

[22] Anderson, A., 2009. The great melt: The coming transformation of the Arctic.

[23] Idem.

[24] Rotnem, T., 2016.

[25] Gazprom Neft, 2016. Prirazlomnoye. [pdf] Available at: <http://www.gazprom-neft.com/company/business/exploration-and-production/new-projects/prirazlomnoe/> [Accessed 6 November 2016].

[26] Gazprom Neft, 2016. Novoportovskoye, [pdf] Available at: <http://www.gazprom-neft.com/company/business/exploration-and-production/new-projects/new-port/>[Accessed 6 November 2016].

[27] Dadwal, S. R., 2014.

[28] Idem.

[29] Russian Direct Investment Fund, 2014. Gas industry facts and figures. [pdf]] Available at: <http://investinrussia.com/data/files/sectors/RDIF-Brochure-Gas-download.pdf> [Accessed 5 February 2017].

[30] Dadwal, S. R., 2014.

[31] Russian Direct Investment Fund, 2014. Investment Announcements 2014. [online] Available at: <http://investinrussia.com/investment-tools/announcement?region=Republic+of+Sakha+%28Yakutia%29&per_page=20> [Accessed 5 February 2017].

[32] Russian Direct Investment Fund, 2014. Investment Announcements 2014.

[33] Dadwal, S. R., 2014.

[34] Idem.

[35] Idem.

[36] Idem.

[37] Idem.

[38] Russian direct investment fund, 2013. Transport industry: freight transportation, facts and figures. “Structure of external cargo flow in Russia by transport type.” pg. 27. [pdf] Available at: <http://investinrussia.com/data/files/sectors/TransportEng.pdf> [Accessed 5 February 2017].

[39] Northern Sea Route information office, 2017. Transport volume on the Northern Sea Route increased in 2016. [online] Available at: <http://www.arctic-lio.com/node/264> [Accessed 5 February 2017].

[40] Rotnem, T., 2016.

[41] Fjærtoft, D., Lindgren, P., Loe, J., and Lunden, L., 2011. Commerciality of Arctic offshore gas: A comparative study of the Snøhvit and Burger fields. [pdf] Available at: <https://www.oxfordenergy.org/wpcms/wp-content/uploads/2014/11/WPM-56.pdf> [Accessed 4 November 2016].

[42] Fjærtoft, D., Lindgren, P., Loe, J., and Lunden, L., 2011. Commerciality of Arctic offshore gas: A comparative study of the Snøhvit and Burger fields.

[43] Idem.

[44] Dadwal, S. R., 2014.

[45] Idem.

[46] Idem.

[47] Idem.

[48] Rotnem, T., 2016.

[49] Idem.

[50] Clifford, R., 2016. How has cooperation in the Arctic survived Western-Russian geopolitical tension? The Polar connection, [online] 18 December. Available at: <http://polarconnection.org/cooperation-arctic/> [Accessed 16 May 2017].

[51] Clifford, R., 2016. How has cooperation in the Arctic survived Western-Russian geopolitical tension?

[52] Ministry of Foreign Affairs of the Russian Federation, 2016. Foreign policy concept of the Russian Federation. [pdf] Available at: <http://www.mid.ru/en/foreign_policy/official_documents/-/asset_publisher/CptICkB6BZ29/content/id/2542248> [Accessed 16 May 2017].

[53] Clifford, R., 2016.

[54] Ministry of economic development of the Russian Federation, 2017. Integrated foreign economic information portal. [pdf] Available at: <http://www.ved.gov.ru/eng/investing/investing-climat/> [Accessed 5 February 2017].

[55] Ministry of economic development of the Russian Federation, 2017. Integrated foreign economic information portal.