by Pierre Jouvellier

National energy mixes for many countries in the world are currently changing from coal to natural gas. It is not surprising to see new emerging markets like India, China and South Africa for natural gas. Indeed, even if coal remains the less expensive fossil fuel for electricity generation, countries are more attracted by natural gas for environmental reasons. However, environment is not the only issue. With new players on the gas market, natural gas is becoming a global commodity and is increasingly available thanks to LNG technology and the shale revolution. India is one the most promising targets for natural gas. With a population of more than 1 billion and huge ambitions in terms of industry, India seems to be a good opportunity for large gas producers such as Russia, Qatar, Iran, and even the US if they sustain their production profile and LNG export plans.

Since the international sanctions on Iran have been lifted, the Islamic Republic is in the starting blocks to launch several oil and gas projects. With the largest gas reserves in the world, Iran has enormous ambitions regarding fossil fuel production. Under the sanctions, Iran did not have sufficient financial reserves to invest in massive gas projects. The country which has a huge potential, ran late in the energy race and is now aiming to provide to neighbouring countries by pipeline. The benefits of gas exports to India include a boost for job creation in the region and of course a regional economic integration. However, the country has to face several geopolitical and technical problems. First of all, Iran does not have any liquefaction terminal for the moment and even if the LNG solutions seems to be a good alternative to supply Europe, Iran is more interested in supplying neighbouring countries via pipelines.

India is the main target, with only 9% of natural gas in its energy mix for the moment, the country is about to increase its gas consumption and looking for energy security by contracting agreements with the Islamic Republic. Before the end of sanctions, the Iran Pakistan India Pipeline (IPI), also called the peace pipeline, was supposed to provide natural gas to India from Iran through Pakistan. This project was aimed at constructing a 2,700 km pipeline from Iran’s South Pars fields in the Persian Gulf to Pakistan’s major cities of Karachi and Multan and then further to Delhi, India. The Iranian section was supposed to be 1,100 km, the Pakistani section 1,000 km and the Indian section 600 km for a total capacity of 110 million cubic meters per day. However, due to the international sanctions, the government transition in Pakistan and the US pressure in the region, the pipeline was not ready to supply India. According to Gholamreza Ansari, the current Iranian ambassador to India, “you can forget about the pipeline. The Americans will simply not allow this project to take off”. Despite the failure of IPI, Iran’s ambition to export natural gas to India is still here.

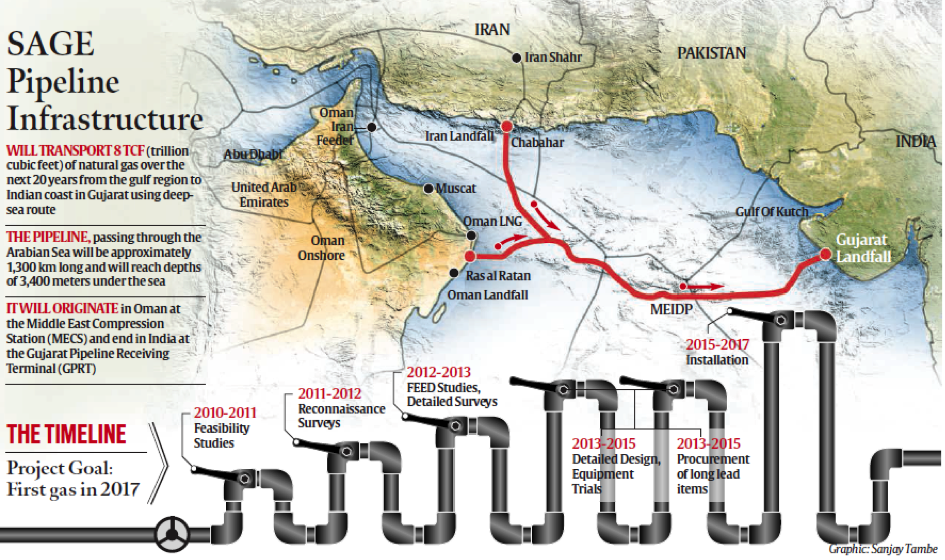

Therefore, Iran is currently looking for another route to India. The alternative would be to build a subsea gas pipeline to supply both Oman and India through the Oman sea and the Arabian sea (Figure 1). This 1,200-1,300 km gas pipeline seems to be the best solution to supply India bypassing Pakistan. This new 4.5 billion dollar project called the MEIDP for Middle East to India Deepwater Pipeline would transport 31.5 million cubic meters of gas per day (equivalent to 10 bcm per year).

Figure 1. IPI alternative route

Moreover, Iran is not be the only potential gas provider to India. Indeed, according to the South Asia Gas Enterprise (SAGE), the aim of such pipeline is to build a kind of “gas highway” that will connect the gas providers from Middle East to India, for the transportation of natural gas to increase India’s energy security (Figure 2). “Linking the Middle East gas fields with India across the Arabian Sea for an offshore distance of 1300 kilometres and maximum water depth of 3400 meters, the SAGE gas transmission pipeline is designed to transport up to 11.2 bcm per year into the Indian energy markets”. In addition to this, India could also save between 1.5 and 2 dollars per MMBtu replacing LNG imports in Dahej, by gas supplied through the MEIDP, and Iran would save about 200 million dollars transit costs per year bypassing Pakistan.

Figure 2. SAGE pipeline infrastructure – Source : SAGE India

Regarding the TAPI for Turkmenistan-Afghanistan-Pakistan-India pipeline (Figure 3), the route is much less secured than the offshore solution. Indeed, this pipeline which aims to provide 33 bcm at full capacity from the Galkynysh gas field in Turkmenistan is not offshore and has to pass through several unstable transit states. Recently, the Turkmen side has completed the first kilometres of the section, the 1,814 km multi billion dollar pipeline will pass through Afghanistan (774 km) a risky region. In addition to the risk of confrontations between the Islamic State, local tribes and Talibans, the pipeline has also to cross the South Waziristan in Pakistan and nobody can ensure that Al-Qaeda-affiliated groups or Pakistani Talibans would not attack this section of the pipeline.

Figure 3. TAPI and IPI – Source: Heritage.org

Thus, even if India seems to be the best opportunity for gas producers, the region is still very difficult to supply. India is looking for cheap prices by importing gas from neighbouring countries. Unfortunately, cheap gas prices also means less security, especially if India plans to stop its LNG imports from the Gulf and Nigeria. The deep offshore MEIDP remains the best supply solution, avoiding transit states and conflicts in the region but also by increasing energy cooperation and security between Iran, Oman and India.